- EXCEL INVOICE TEMPLATE UK REGISTRATION

- EXCEL INVOICE TEMPLATE UK PRO

- EXCEL INVOICE TEMPLATE UK DOWNLOAD

The customer details section consists of the client’s details as below:

EXCEL INVOICE TEMPLATE UK REGISTRATION

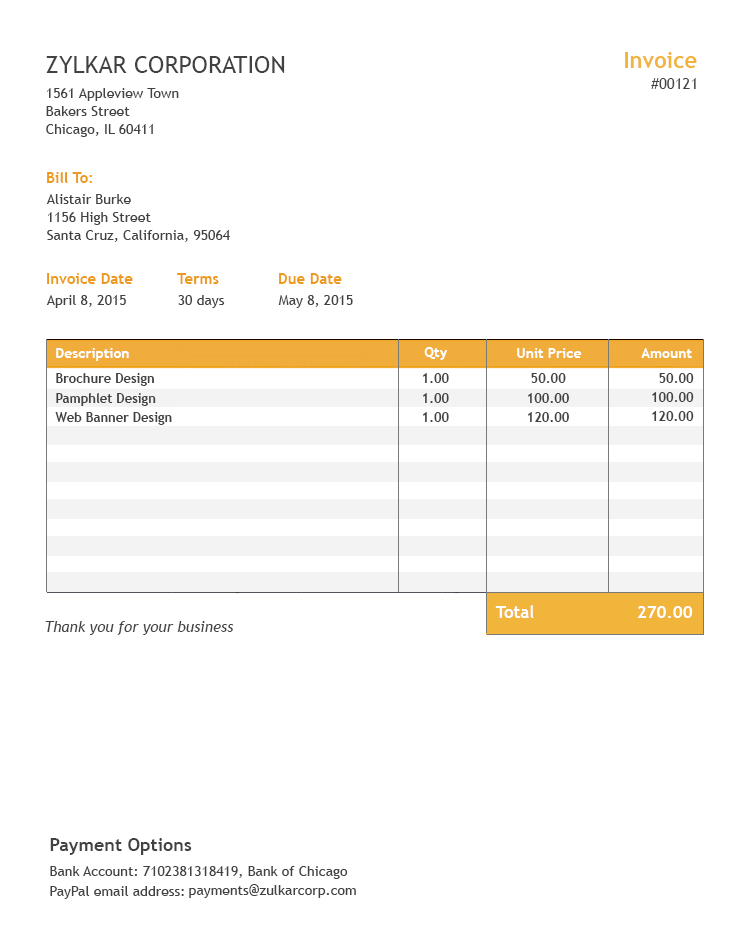

Insert your logo, name and VAt registration number along with your address. The header section consists of your company’s logo, name, VAT Registration Number and the heading of the invoice. The UK VAT Invoice With Discount consists of the Performa of the invoice as per the government guidelines. This enables the user to save time by just selecting the name fo the supplier and the sheet automatically fetches the customer details on the invoice. Insert your customer details once when you are making the first sale and it gets added to the dropdown list. This database sheet is further used to create a dropdown list in the invoice template. These customers are those whom we issue the invoices for the goods supplied or services rendered regularly. You can manually type the customer name and other details when your business type is retail as you have different customers every time businesses that have similar customers every time. This template consists of 2 sheets, one is UK VAT Invoice With Discount Template and the other is the Customer Database sheet. Content of UK VAT Invoice With Discount Excel Template

EXCEL INVOICE TEMPLATE UK DOWNLOAD

You can also download other VAT templates like UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UAE VAT Multiple Tax Invoice, UAE VAT Dual Currency Invoice, and UAE VAT Payable Calculator. Easily issue a VAT compliant invoice to your customers in just a few minutes.Ĭlick here to Download UK VAT Invoice With Discount Excel Template. We have created a UK VAT Invoice With Discount excel template with predefined formulas and formatting as per the above guidelines. UK VAT Invoice With Discount Excel Template Taxable Amount: GBP 500 – GBP 50 = GBP 450.įinal Invoice Amount: GBP 450 + GBP 90 = GBP 540.

Therefore, the calculation will be as follows: Supplier ABC sells goods worth GBP 500 to his customer offering a discount of 10%. You need to calculate VAT on the Taxable amount. Furthermore, the VAT is charged on discounted prices.

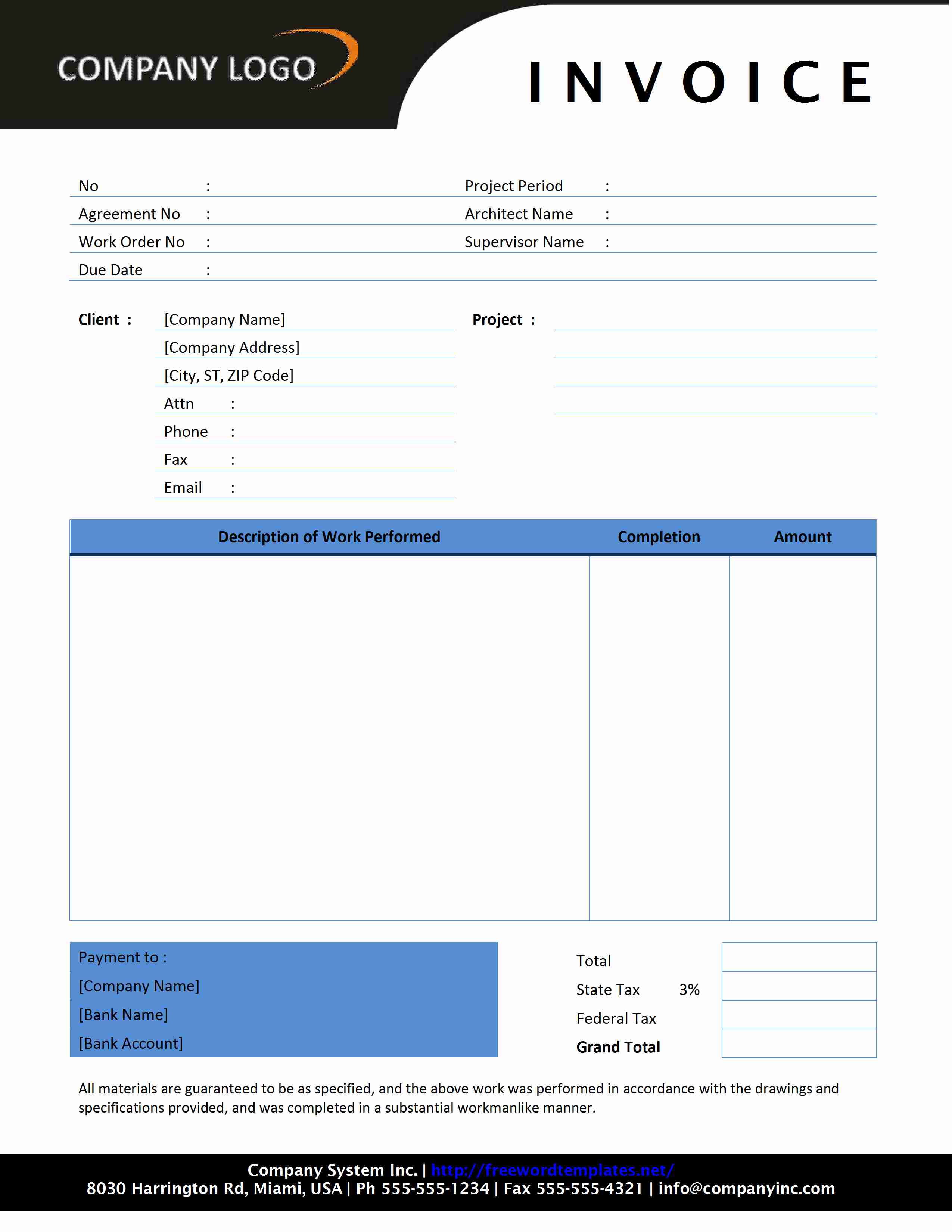

The supplier cannot provide a discount on the final invoice amount which is VAT inclusive. Source: According to the rules, the rate of discount if applicable has to be shown on the invoice. Rate of VAT charged per item – if an item is exempt or zero-rated make clear no VAT on these items The tax point (or ‘time of supply’) if this is different from the invoice dateĬustomer’s name or trading name, and address

Unique invoice number that follows on from the last invoice Guidelines For UK VAT Invoice With Invoice Content of UK VAT Invoice With Discount Excel Template.UK VAT Invoice With Discount Excel Template.Guidelines For UK VAT Invoice With Invoice.

EXCEL INVOICE TEMPLATE UK PRO

0 kommentar(er)

0 kommentar(er)